sarawuth702

Welcome to the August 2022 edition of Electric Vehicle [EV] company news.

August saw a big month of positives led by the Inflation Reduction Act in the USA and also China extending the NEV purchase tax exemption to the end of 2023.

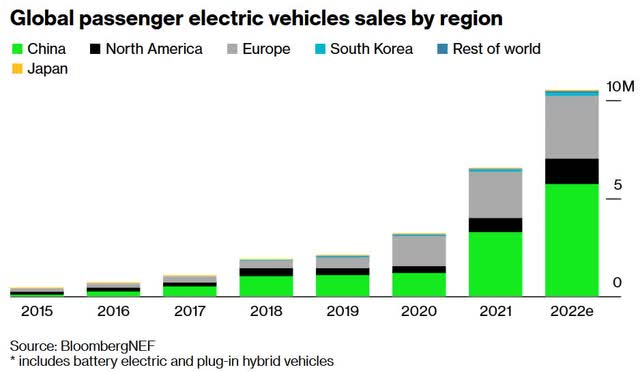

Plugin electric car sales continue to boom in China but have slowed considerably in Europe, along with ICE car sales. USA is improving, but from a low base. BYD Co and Tesla continue to dominate YTD global sales.

Global electric car sales as of end July 2022

Global plugin electric car sales finished July 2022 with 778,000 sales for the month, up 61% on July 2021, with market share of 14% for July 2022, and 12% YTD.

Note: ~72% (not updated recently) of electric car sales YTD were 100% battery electric vehicles (BEVs), the balance being hybrids.

China electric car sales were 505,000 in July 2022, up 112% on July 2021 sales. Electric car market share in China for July was 28%, and 26% YTD.

Europe electric car sales were 157,000 in July 2022, down 5% YoY, reaching 19% market share and 20% YTD. Norway reached 83% share, Sweden 50.1%, Netherlands 31%, Germany 26%, France 19%, and UK 16.7% share in July 2022.

USA plugin electric car sales were discussed by CleanTechnica here, noting they “don’t have US sales data for all electric vehicle models, since automakers don’t break out sales of electric and non-electric versions of the same model.” On August 16 InsideEVs reported that H1 2022 U.S electric car sales were up 60% YoY and reached 5% market share and that Tesla achieved almost 68% share.

Note: The above sales include light commercial vehicles.

Note: An acknowledgement to Jose Pontes and the team at CleanTechnica Sales for their work compiling all the electric car sales quoted above and charts below.

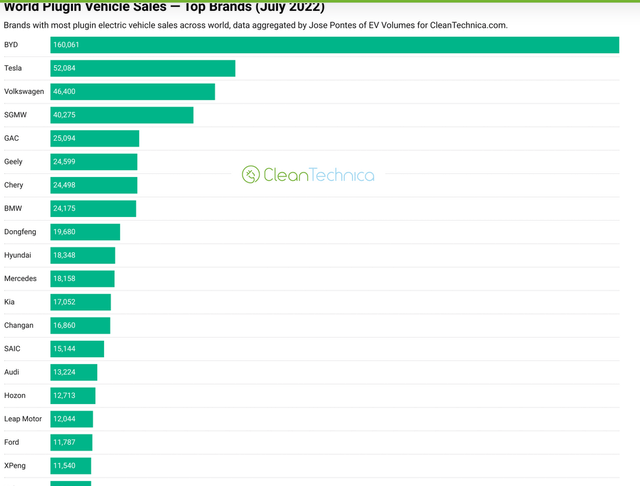

Global plugin electric car sales by brand for July 2022

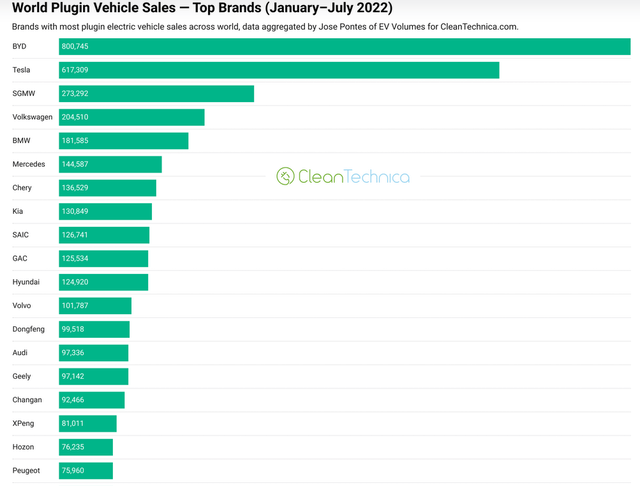

Global plugin electric car sales by brand YTD in 2022

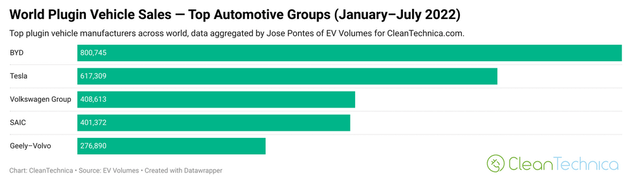

Top plugin electric car sales YTD by auto group

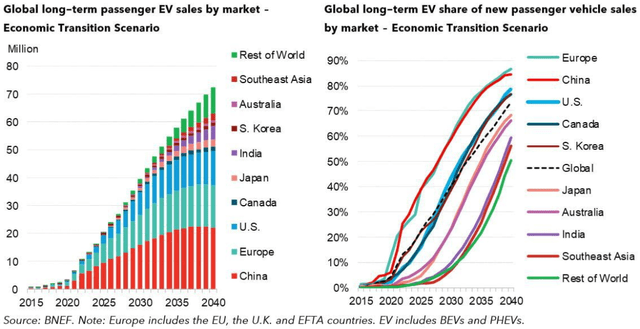

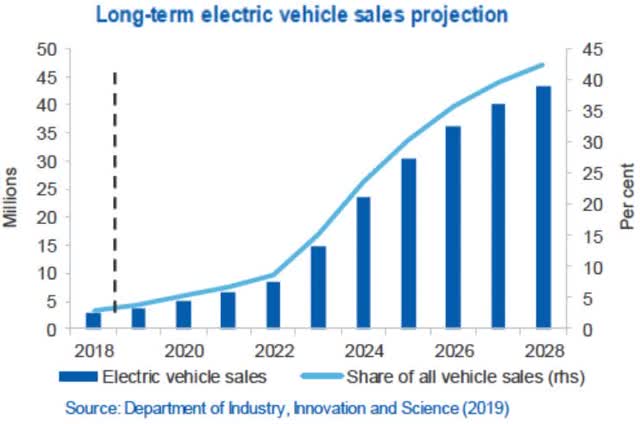

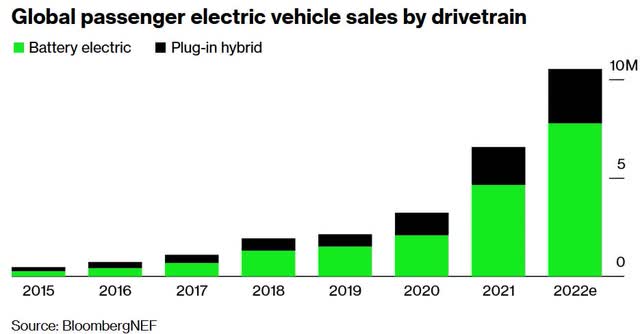

EV sales forecast to really take off from 2022 as affordability kicks in

The chart below aligns with our research that electric car sales will really take-off after 2022.

Mining.com BloombergNEF BloombergNEF

Bloomberg Electric Vehicle Outlook 2022 (published May 2022)

BloombergNEF now forecasts “plug-in electric vehicles sales rise from 6.6 million in 2021 to 20.6 million in 2025” and “by 2025, plug-in electric vehicles represent 23% of new passenger vehicles sales globally, up from just under 10% in 2021”.

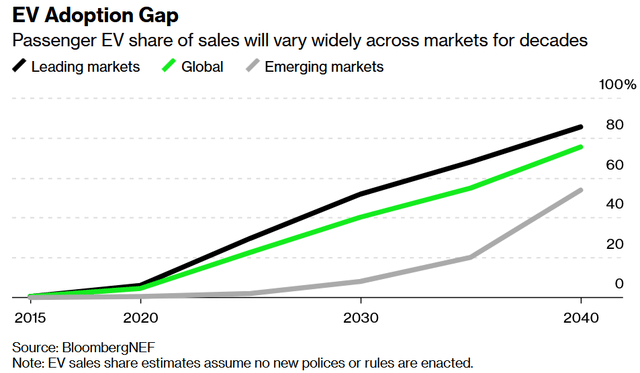

BloombergNEF long term EV forecast (global EV share to exceed 70% by 2040)

BloombergNEF forecasts ~40.4% global passenger EV market share in 2030 and 75.3% in 2040 (published June 2022)

EV market news

On August 3 Investing News reported:

Electric vehicle market update: Q2 2022 in review… 2022 has brought EV supply chain issues, with carmakers struggling with higher costs and production goals… there’s been a slowdown in demand for battery electric vehicles (BEVs) in growth markets such as Europe… “In terms of sales performance, we continue to see production holding back sales,” …Looking ahead, by the end of 2022, global plug-in sales… are on pace to exceed 10 million vehicles… “China will remain the largest market by total sales, already clearing 3 million year-to-date and projected to account for 6.5 million plug in sales by the end of this year.”

On August 9 CNEVPOST reported:

CPCA raises China NEV sales forecast, expects average monthly sales of over 600,000 units in next few months. The CPCA has raised its forecast for new energy passenger vehicle sales in China by 500,000 units to 6 million units in 2022, with the possibility of further increases in the fourth quarter… From January to June, wholesale sales of new energy passenger vehicles in China rose 122.8 percent to 2.466 million units… The CPCA expects China’s new energy commercial vehicle sales to exceed 350,000 units this year, and overall NEV sales will reach about 6.5 million units this year after including special purpose vehicles.

Note: CPCA is the China Passenger Car Association.

On August 9 Green Car Congress reported:

Inflation Reduction Act mandates escalating battery critical mineral requirements to qualify for EV tax credit… Among the changes are an extension of the tax credit through 2032, the removal of the unit-sales cap of 200,000 per OEM, and a new mandate for qualified cars being assembled in North America. Further, the bill as currently written mandates escalating levels of critical minerals to be sourced from the US or a country with a free-trade agreement with the US… Specifically, the bill requires (Part 4, Sec. 13401. subsection [E](1)[A]) that the “percentage of the value” of the applicable battery critical minerals (as defined later in the bill) extracted or processed in the US or a US free-trade partner or recycled in North America, be:

40% for a vehicle placed in service before 1 January 2024;

50% for a vehicle placed in the service during calendar year 2024;

60% for a vehicle placed in service during calendar year 2025;

70% for a vehicle placed in service during calendar year 2026; and

80% for a vehicle placed in service after 31 December 2026.

The bill places similar restrictions on the percentage of value of the components, but leading up to a 100% requirement for vehicles placed in service after 31 December 2028. The bill then goes on to exclude specifically any vehicle placed in service after 31 December 2024… which any of the applicable critical minerals contained in the battery of the vehicle (as described in sub-section [E](1)[A]) were extracted, processed, or recycled by a “foreign entity of concern”… There are 72 EV models currently available for purchase in the United States including battery, plug-in hybrid and fuel cell electric vehicles. Seventy percent of those EVs would immediately become ineligible when the bill passes and none would qualify for the full credit when additional sourcing requirements go into effect. Zero.

On August 10 Reuters reported: “U.S. automakers say 70% of EV models would not qualify for tax credit under Senate bill.”

On August 18 Electrive reported:

Xiaomi to use BYD & CATL batteries for first BEV… According to earlier reports, the first of four electric models is expected to hit the market in 2024.

On August 19 Reuters reported:

China extends NEV purchase tax exemption worth 100 billion yuan. China will extend its exemption of new energy vehicles’ from purchase taxes to the end of 2023, creating tax cuts worth a total of 100 billion yuan, state media Xinhua quoted cabinet meeting as saying on Friday.

On August 21 CNBC reported:

Australian bank to scrap loans for new diesel and gasoline cars as country looks to increase EV uptake… from 2025, Bank Australia will continue to provide them for used ones.

On August 25 Jalopnik reported:

California will become the first state to ban gasoline cars. The decision is set to take effect by 2035, and over a dozen other states are expected to follow.

On August 28 Bloomberg Hyperdrive reported:

France prepares $100 a month electric-car leasing plan… The scheme will make EVs available for 100 euros ($100) a month, Budget Minister Gabriel Attal said Sunday on LCI television, noting that the cost is less than what many people spend on gasoline. The government is working on how quickly the measure can be rolled out and the availability of EVs, he said. Macron promised a state-sponsored leasing program for low-income households to counter criticism that even with subsidies, EVs are still out of reach for many.

EV company news

BYD Co. [SHE: 002594][HK:1211](OTCPK:BYDDY) (OTCPK:BYDDF)

BYD is currently ranked the number 1 globally with 16.2% market share YTD. BYD is ranked number 1 in China with 27.8% market share in YTD.

On August 2 Wheels reported: “BYD Dolphin and Seal confirmed as part of aggressive model expansion in Australia…”

On August 4 The Driven reported:

BYD sets another sales record in July 2022… BYD has set achieved its highest monthly vehicle sales on record, with 162,530 sales a 222 per cent increase for July over the same month a year ago.

On August 25 Seeking Alpha reported:

China’s BYD plans to launch e-SUV in India… BYD Company will be exhibiting a Born Electric SUV for the Indian market by the fourth quarter of the current calendar year, The Economic Times reported. The deliveries of the same would begin in January, the company’s top official said.

On August 26 Electrek reported:

BYD may be about to launch a premium $145k+ EV… According to a new report from First Financial, a news outlet in China, BYD is planning to increase the price of its high-end brands to over 1 million yuan (around $145,000). Previously, BYD’s high-end models ranged between 800,000 and 1.5 million yuan (about $116,000 to $218,000)…

On August 29 Bloomberg reported:

BYD’s first-half net income triples to top end of forecast… Net income in the six months through June tripled from a year earlier to 3.6 billion yuan ($521 million).

On August 30 Bloomberg reported:

Warren Buffett cuts stake in China’s BYD, spurring bets more may come. Berkshire cut position in carmaker from 20.04% to 19.92%.

Tesla Inc. (NASDAQ:TSLA)

Tesla is currently ranked the number 2 globally with 12.5% global market share YTD. Tesla is number 3 in China with 7.2% market share YTD. Tesla is number ~7 in Europe with 6.8% market share YTD. Tesla is still the number 1 electric car seller in the US by far with ~68% market share.

On August 6 Yahoo Finance reported:

Tesla shareholders approve 3-for-1 stock split, Musk teases Cybertruck… on production, he said that Tesla passed the three million market in terms of cars produced overall… He says that in the next 10 years, he sees 100 million cars being produced. And that he ideally see that the company will have 12 factories around the world. And hopefully, he did say that the next step he might be in North America, and teased Canada as the next location… He says that they’re on track for 2023 (Cybertruck) production, midway through the year. But the specs and pricing likely to change.

On August 9 Global News.ca reported: “Tesla lobbying Ontario government as part of effort to set up Canadian manufacturing facility.”

On August 10 Bloomberg reported:

Tesla, GM score biggest share of $1.2 billion EV order from startup Autonomy. Autonomy building fleet of 23,000 battery-powered vehicles. Order represents 1.2% of projected EV production in US.”

On August 10 Seeking Alpha reported: “Elon Musk tweets Tesla Semi 500-range variant starts shipping this year.”

On August 10 CNEVPOST reported:

BREAKING: BYD supplying batteries to Tesla, first vehicles to roll off line as soon as August, report says. BYD’s blade batteries has begun delivery to Tesla’s factory in Berlin, and the Tesla Shanghai factory has no plans to use BYD batteries for the time being, according to local media.

On August 17 Seeking Alpha reported: “Tesla is closer to opening up Superchargers stations to other EV brands… in the U.S.”

On August 19 InsideEVs reported: “Rumor: China-made Tesla Model 3 to get CATL’s M3P batteries. It could potentially boost the driving range by 10% or so.”

Investors can read our past article: “Tesla – A Look At The Positives And The Negatives“, where we rated the stock a buy. It was trading at USD 250 (post 5:1 stock split and 3:1 split is equivalent to USD 16.67). Investors can also read the latest Tesla Trend Investing Tesla article here.

Volkswagen Group [Xetra:VOW](OTCPK:VWAGY) (OTCPK:VLKAF)/ Audi (OTCPK:AUDVF)/ Lamborghini/ Porsche (OTCPK:POAHF)/ Skoda/ Bentley

‘Volkswagen Group’ is currently ranked the number 3 top-selling global electric car manufacturer with 8.3% market share YTD, and 1st in Europe with 19.4% market share YTD.

On August 3 Electrek reported: “Audi EV models featured in hit Netflix film, plans to ramp US EV output…”

On August 15 Volkswagen reported: “Mahindra and Volkswagen explore strategic alliance to accelerate electrification of Indian Automotive Market.”

On August 23 The Verge reported:

VW strikes a deal with Canada to build EV batteries in North America. The automaker is probably going to build a gigafactory in Canada so its EVs qualify for the tax credit.

On August 23 Volkswagen reported: “Volkswagen Group and Canada aim to advance sustainable battery supply chain in North America.” Highlights include:

- “Volkswagen signs agreement with Prime Minister Justin Trudeau’s government on battery value creation and raw material security.

- Volkswagen Group’s battery company PowerCo pushes ramp-up of its global battery business, further proof of Volkswagen’s ambitious growth strategy in North America.”

On August 23 The Driven reported: “Volkswagen will sell only EVs in Norway from 2024…”

Wuling Automobile JV (SAIC 51%, GM 44%, Guangxi 5.9%), SAIC Motor Corporation Limited [SAIC] [CH:600104] (SAIC includes Roewe, MG, Baojun, Maxus)

SGMW (SAIC-GM-Wuling Automobile) is number 4 globally with 8.1% market share YTD. SAIC/GM/Wuling JV (SGMW) is 2nd in China with 9.5% share YTD.

On August 9 SAIC-GM-Wuling (SGMW) reported: “SAIC-GM-Wuling’s EV sales in China exceed 1 million units…”

On August 11 SAIC Motor reported:

SAIC Motor reports 43.7% sales jump in July… In July, sales of SAIC Motor’s self-owned brand cars, new energy vehicles (NEVs), and exports all maintained steady growth… Sales of its NEVs reached 106,000 in July, surging 118.1 percent year-on-year, while overseas sales hit a record high of 98,000 units, a year-on-year increase of 91.3 percent, according to official data.

On August 25 (SAIC-GM-Wuling (SGMW) reported: “SAIC-GM-Wuling expands electric vehicle lineup with Wuling Asta Hybrid…”

Geely Automobile Holdings Ltd (OTCPK:GELYY, HK:0175), Volvo Cars, Kandi Technologies Group (NASDAQ:KNDI), Proton, Lotus, ZEEKR. (Note: Volvo Group is a separate company that makes e-trucks & e-buses)

Geely/Volvo is currently ranked number 5 in the global electric car manufacturer’s sales ranking with 5.6% global market share YTD.

On August 18 Reuters reported: China’s Geely wants half its vehicle sales to be electric in 2023 – CEO.”

On August 27 CATL reported: “CATL and ZEEKR sign five-year strategic cooperation agreement, first volume of Qilin batteries to power ZEEKR models.”

Stellantis N.V. (NYSE:STLA) (merger Fiat Chrysler Group (FCA) and the Peugeot Group (PSA)) Ferrari

Stellantis Group is currently ranked the number 6 in the global electric car manufacturer’s sales with 5.4% global market share YTD. Stellantis is ranked 2nd in Europe with 16.7% market share YTD.

On August 17 Reuters reported: “Stellantis plans a profitable goodbye for combustion muscle cars.”

Hyundai (OTC:HYMTF), Kia (OTC:KIMTF)

Hyundai-Kia Group is currently ranked number 7 in the global electric car manufacturer’s sales ranking with 5.2% market share YTD. Hyundai-Kia Group is ranked 3rd in Europe with 11.6% market share YTD.

On August 1 Kia reported:

Kia announces July 2022 global sales results. Continuing strong EV sales in the second quarter of 2022, Kia sold 8,171 units of the EV6 globally in July, further accelerating the company’s EV transition. In the second quarter, retail sales of Kia’s BEV models accounted for 44,000 units, a 98 percent increase year-on-year.

On August 2 Hyundai reported: “Hyundai Motor America reports July 2022 sales. Green Cars sales increased 12% over July 2021.”

On August 13 Inside EVs reported: “Hyundai Motor reports over 16,000 BEV retail sales in July 2022…”

On August 18 Hyundai reported: “Hyundai IONIQ 5 wins Car and Driver’s 2022 EV of the Year Award…”

On August 25 Kia reported: “The Kia EV9 undergoes final technical testing ahead of 2023 world debut.”

Kia EV9 undergoing terrain test

Kia

BMW (OTCPK:BMWYY), Mini, Rolls-Royce

BMW Group is currently ranked the number 8 global electric car manufacturer with 3.7% global market share YTD. BMW Group is ranked 4th in Europe with 11.1% market share YTD.

On August 1 BMW Group reported: “E-drive production expands in Leipzig: Second battery module line goes on stream.” Highlights include:

- “E-component production expands.

- Manufacture of battery modules for BMW i4.

- €70 million invested.

- 250 new jobs created.

- Plant Director Petra Peterhänsel: “Plant Leipzig remains electrified”.”

On August 3 BMW Group reported: “BMW Group half-year report to 30 June 2022.” Highlights include:

- “…BEV sales more than double in 1st half-year (+110.3%).

- Persistent supply bottlenecks ‒ solid sales volume growth in 2nd half-year yoy expected…”

On August 17 Reuters reported: “Exclusive: China’s EVE to supply BMW with large Tesla-like cylindrical batteries in Europe.”

Daimler-Mercedes (OTCPK:DDAIF, OTCPK:DDAIY) (Smart – 50% JV between Daimler & Geely) (NB: A proposal to rename Daimler to Mercedes Benz)

Daimler-Mercedes is ranked number 9 globally with 2.9% market share.

On August 9 The Driven reported: “Mercedes-Benz EQS EVs amongst 12,000 vehicles recalled in China…”

On August 9 Mercedes Blog reported:

Sales launch Mercedes EQS SUV: From 110,658.10 Euros. Mercedes has announced pricing for the Mercedes EQS SUV electric luxury SUV whose deliveries will begin in December 2022…

On August 23 Mercedes Blog reported:

Mercedes EQG will be the first to get the new high energy density battery… Mercedes is currently working on a high energy density battery that uses a silicon anode instead of the graphite anode found in conventional batteries. This technology promises that the energy density in the battery will increase by 20-40% to 800 Wh/l… The new battery is being developed together with US partner Sila Technologiers and is being tested on the Mercedes EQXX concept which has already completed several 1000 km long runs between charges. The EQXX battery has a capacity of 100 kWh, weighs only 495 kg and is more compact and lighter than the 107.8 kWh battery in the EQS.

On August 26 Mercedes Blog reported: “Mercedes starts production of the Mercedes EQS SUV in Alabama.”

GAC Group (Guangzhou Automobile Group Co. Ltd.)

GAC Group is ranked number 10 globally with 2.5% market share YTD.

On August 4 GAC Group reported: “GAC Bahrain boosts renewable output with solar development project….”

On August 26 Technode reported:

GAC steps up to produce EV batteries in house. Chinese automaker GAC Group announced plans on Thursday to invest RMB 10.9 billion (nearly $1.6 billion) in setting up an electric vehicle battery firm, as the Toyota manufacturing partner races to scale up its own battery production amid rising costs and a supply shortage. The wholly owned subsidiary will begin constructing a battery plant with an annual capacity of 26.8 gigawatt-hours [GWH] by December. They will initially produce affordable lithium iron phosphate (LFP) battery packs for Aion, the EV unit of the state-owned manufacturer, followed by other business divisions after 2025. EV startup Nio made a similar move, currently building a $32.8-million battery research facility in Shanghai.

XPeng Inc. (Xiaopeng Motors) (XPEV) [HK:9868]

On August 1 XPeng Inc. reported: “XPeng announces vehicle delivery results for July 2022.” Highlights include:

- “11,524 vehicles delivered in July 2022, a 43% increase year-over-year.

- 80,507 total vehicles delivered in the first seven months of 2022, a 108% increase year-over-year.”

On August 23 XPeng Inc. reported: “XPeng reports second quarter 2022 unaudited financial results.” Highlights include:

- “Quarterly total revenues reached RMB7,436.3 million, a 97.7% increase year-over-year.

- Quarterly vehicle deliveries reached 34,422, a 98% increase year-over-year.

- Quarterly gross margin was 10.9%, a decrease of 100 basis points year-over-year.”

On August 24 CNBC reported: “Chinese EV maker Xpeng teases two new cars – and one will compete with Tesla’s Model Y.”

Great Wall Motors [HK:2333] (OTCPK:GWLLF) (OTCPK:GWLLY) [ORA]

On August 9 Great Wall Motors reported:

Great Wall Motor’s ‘SVOLT’ Battery Company announces success in developing 20Ah sulfur-based solid-state prototype cells, increasing electric vehicle range to 1,000 km…

On August 10 Car Expert reported:

GWM accelerates European push with Ora and Wey brands. Great Wall Motor (GWM) is growing rapidly in Australia, and it’s a powerhouse in China. Now, it wants to take on Europe…

On August 22 CNEVPOST reported:

Great Wall Motor’s Haval brand to stop selling ICE vehicles in 2030… becoming the latest local brand to do so. Haval aims to have 80 percent of the brand’s sales be new energy vehicles (NEVs) by 2025.

Ford (NYSE:F)

On July 22 Reuters reported: “Ford to buy cheaper CATL EV batteries to catch Tesla.”

On August 10 Reuters reported:

Ford raises prices of electric F-150 pickup amid high commodity costs… The automaker said prices for its 2023 F-150 lightning will be increased in the range of $6,000 and $8,500 depending on the variant, with the cheapest Pro model now priced at about $47,000.

On August 23 Bloomberg reported:

Ford to cut 3,000 jobs to fund shift toward electric vehicles. Ford plans to build 2 million electric vehicles a year by the end of 2026, up from less than 64,000 last year.

Li-Auto (LI) [HK:2015]

On August 1 Li-Auto reported:

Li Auto Inc. July 2022 delivery update. Li Auto Inc. (“Li Auto” or the “Company”) (Nasdaq: LI; HKEX: 2015), a leader in China’s new energy vehicle market, today announced that the Company delivered 10,422 Li ONEs in July 2022, up 21.3% year over year. The cumulative deliveries of Li ONE have reached 194,913 since the vehicle’s market debut in 2019.

On August 11 Reuters reported: “China’s Didi EV joint venture with Li Auto applies for bankruptcy – court.”

On August 15 Li-Auto reported:

Li Auto Inc. announces unaudited second quarter 2022 financial results. Quarterly total revenues reached RMB8.73 billion (US$1.30 billion)1. Quarterly deliveries reached 28,687 vehicles. Quarterly gross margin reached 21.5%.

NIO Inc. (NIO)

On August 1 NIO Inc. reported: “NIO Inc. provides July 2022 delivery update.” Highlights include:

- “NIO delivered 10,052 vehicles in July 2022, increasing by 26.7% year-over-year.

- NIO delivered 60,879 vehicles year-to-date 2022, increasing by 22.0% year-over-year.

- Cumulative deliveries of NIO vehicles reached 227,949 as of July 31, 2022.”

On August 2 The Driven reported: “Nio plans new brand to make more EVs affordable…”

Renault [FR:RNO] (OTC:RNSDF)/ Nissan (OTCPK:NSANY)/ Mitsubishi (OTCPK:MSBHY, OTCPK:MMTOF)

On August 7 Bloomberg reported:

Renault is on right track with new electric vehicle, CEO says. Renault SA Chief Executive Officer Luca de Meo said the uptake of the new Megane E-Tech EV model shows the French carmaker is on the right track with its turnaround at a time of increased challenges for the automotive industry. Renault sold 25,000 Megane E-Tech vehicles in three months….

On August 10 Electrek reported: “Renault’s Megane E-Tech is now France’s most popular EV with a 100K/year run rate…”

On August 12 Mitsubishi reported: “Mitsubishi Motors introduces the all-new Outlander PHEV Model in Australia.”

General Motors/Chevrolet (NYSE:GM)

On August 9 Car Expert reported: “General Motors to produce Corvette, Cadillac electric sedans – report…”

On August 10 Electrek reported:

GM’s CFO says the automaker is hitting an inflection point, scaling EV production. GM is aggressively electrifying its fleet, despite shortages and supply chain disruptions. Meanwhile, GM plans to scale EV production this year with a slate of new models and several deals to lock up critical EV resources… GM is doubling its EV production target from 1 million by 2025 to 2 million. The company believes its diverse lineup can attract customers in any market…

Toyota (NYSE:TM)/ Lexus

On August 4 The Driven reported: “Toyota offers to buy back EVs from customers affected by bZ4X recall.”

On August 15 Arena EV reported: “Suzuki to build its first EV with help from Toyota…”

On August 25 Electrek reported:

Toyota says there’s no EV demand – maybe try selling one the wheels stay on? Toyota is at it again, claiming that there’s not enough demand in the United States for electric vehicles – most of which are currently suffering from months of backlog in the United States due to high demand. Even their own bZ4X has a waiting list because, well, the wheels keep falling off.

Beijing Automotive Group Co. (BAIC)(includes Arcfox) [HK:1958) (OTC:BCCMY)

On August 26 Bloomberg reported:

Xiaomi in talks with BAIC to reach goal of making cars. Smartphone giant may produce co-branded EVs built by BAIC. Tie-up could help Xiaomi keep promise to make cars by 2024.

Rivian Automotive (RIVN)

On August 11 Reuters reported:

EV maker Rivian says its current models will not qualify for tax breaks. Electric-vehicle maker Rivian Automotive Inc on Thursday forecast a wider operating loss for the year and also said many of its current models will not qualify for new federal tax incentives.

On August 19 Bloomberg Hyperdrive reported: “Rivian cancels least expensive version of electric pickup truck.”

Lucid Group (LCID)

On August 3 Lucid Group reported: “Lucid announces second quarter 2022 financial results, reports strong demand while lowering production guidance for the year.” Highlights include:

- “Q2 revenue of $97.3M driven by customer deliveries of 679 vehicles in the quarter.

- Strong demand with over 37,000 reservations, representing potential sales of approximately $3.5B.

- Production volume outlook for 2022 revised to a range of 6,000 to 7,000 vehicles.”

On August 4 Bloomberg reported:

Lucid Motors slashes 2022 production target in half; shares sink. Lucid Group Inc. fell as much as 13% in late trading after the luxury electric-vehicle startup halved its 2022 production target to 6,000 to 7,000 cars. It’s the second time the Newark, California-based startup has reduced its output goal this year, from an original target of 20,000 cars. Saudi-backed Lucid said it produced 1,405 vehicles in the first half of 2022 and attributed the lower full-year target to “extraordinary supply chain and logistics challenges.” The company delivered just 1,039 cars.

On August 19 Lucid Group reported: “Introducing Sapphire: The Pinnacle of Electric Performance.” Highlights include:

- “…Sub-two seconds 0-60 mph, sub-four seconds 0-100 mph, sub-nine seconds quarter mile, and top speed exceeding 200 mph.

- Production begins in first half of 2023.”

Lucid Air Sapphire

Lucid Group

On August 30 Reuters reported:

EV maker Lucid files for new offering to raise $8 billion in stages. Lucid Group Inc on Monday filed for a new offering of up to $8 billion as the luxury electric-vehicle maker looks to beef up working capital at a time when supply snarls have crimped its production.

Polestar Automotive Holding UK PLC (PSNY)

On August 16 Polestar reported: “The emotions of performance: Polestar 6 to enter production.”

A blue Polestar O₂ convertible, side view

Polestar

On August 23 Polestar reported: “Polestar to supply batteries to electric hydrofoil boat company Candela.”

Tata Motors (TTM) group (Jaguar, Land Rover)

On August 1 Tata Motors reported: “… Tata Motors sold 4,022 electric vehicles in July 2022, reporting a YoY sales growth of 566%.”

On August 7 Tata Motors reported: “Tata Motors signs Definitive Agreement for the acquisition of Ford India’s Sanand plant…”

On August 18 Tata Motors reported:

Tata Motors wins order of 921 electric buses from Bengaluru Metropolitan Transport Corporation. Wins orders for over 3,600 electric buses in under 30 days.

GreenPower Motor Company Inc. [TSXV:GPV] (GP)

On August 3 GreenPower Motor Company Inc. reported:

GreenPower completes first deliveries of EV Star Cab and Chassis to Workhorse for the production of Workhorse’s New Class 4 W750 Step Van…

On August 15 GreenPower Motor Company Inc. reported: “GreenPower reports fiscal first quarter 2023 results.” Highlights include:

- “Recorded revenues of $3,851,105 for the current quarter an increase of 29% over the revenue of $2,980,086 for the same quarter last year.

- Gross profit of 28.8% of revenue.

- Cash including restricted cash of $5.4 million at the end of the period.

- Inventory of $39.7 million including finished goods of $24.6 million.

- Working capital at the end of the quarter of $28.3 million.”

Investors can also read our Trend Investing article on GreenPower here.

Workhorse Group Inc. (WKHS)

On August 9 Workhorse Group Inc. reported:

Workhorse Group reports second quarter 2022 results… Signed a three-year contract manufacturing agreement to assemble vehicles for Tropos Technologies in Union City beginning in Q4 2022…

Lion Electric (LEV)

On August 5 Lion Electric reported: “Lion Electric announces second quarter 2022 results.” Highlights include:

- “Delivery of 105 vehicles, an increase of 44 vehicles, as compared to the 61 delivered in the same period last year.

- Revenue of $29.5 million, up $12.8 million, as compared to $16.7 million in Q2 2021…

- Net earnings of $37.5 million, as compared to a net loss of $178.5 million in Q2 2021. Net earnings for Q2 2022 include a $56.9 million gain related to non-cash decrease in the fair value of share warrant obligations…

- Establishment of cross-border $125 million “at-the-market” equity program (“ATM Program”).

Nikola Corporation (NKLA)

On August 1 Nikola Corporation reported: “Nikola agrees to acquire Romeo Power, to bring battery pack engineering and production in-house.”

On August 4 Nikola Corporation reported: “Nikola Corporation reports second quarter 2022 results.” Highlights include:

- “Produced 50 Nikola Tre BEVs in Coolidge, Arizona, and delivered 48 to dealers.

- Reported revenues of $18.1 million, GAAP net loss per share of $0.41, and non-GAAP net loss per share of $0.25.

- Cash & Restricted Cash of $529.2 million and $312.5 million remaining ELOC commitment totaling $841.8 million in total liquidity at the end of Q2, up from $794.0 million in Q1.

- Announced station progress in California in the cities of Ontario, Colton, and a location servicing the Port of Long Beach.

- Stockholders approved proposal 2 increasing authorized shares from 600 million to 800 million.”

On August 10 Nikola Corporation reported: “Nikola announces Leadership Succession; Michael Lohscheller to become CEO.”

Honda [TYO:7267] (HMC) (OTCPK:HNDAF)

On August 29 Honda reported:

LG Energy Solution and Honda to form joint venture for EV battery production in the U.S…. With this agreement, LGES and Honda will invest a total of USD $4.4 billion and establish a new JV plant in the U.S. The plant aims to have an annual production capacity of approximately 40GWh… While the location for the joint venture plant is yet to be finalized, based on Honda’s plans for EV production in North America, the two companies aim to begin construction in early 2023, in order to enable the start of mass production of advanced lithium-ion battery cells by the end of 2025.

Near-term potential EV producing companies

Lordstown Motors (RIDE)

On August 22 Lordstown Motors reported: “Lordstown Motors reports second quarter 2022 financial results.” Highlights include:

- “Ending cash balance of $236 million is above internal expectations and extends our runway, due in part to disciplined expense controls and rigorous program management.

- Closed Asset Purchase Agreement with Foxconn (“APA”), generated $107.5 million cash proceeds in 2Q22 and $257.5 million in total proceeds…

- Closed Contract Manufacturing Agreement, transferred the plant and approximately 400 manufacturing employees to Foxconn, reducing operating complexity and cost, and solidifying path to a less capital intensive and highly variable cost structure.

- Formed a Joint Venture with Foxconn – LMC becomes Foxconn’s primary development partner for electric vehicles in the North American commercial market.

- Continued progress with testing, validation and certification activities to prepare the Endurance for Q3 commercial release production and Q4 customer deliveries.

- Appointed Daniel Ninivaggi as Executive Chairman, promoted Edward Hightower to CEO and added several automotive veterans to strengthen senior management team.

- Targeting a limited number of strategic fleet customers for the Endurance and anchor customers for the first vehicle to be produced with Foxconn through our joint venture.”

Arrival (ARVL)

On August 5 Electrek reported: “Arrival to reportedly shelve Bus and Uber Car to cut costs and prioritize Van deliveries…”

Fisker Inc. (FSR)

On August 3 Fisker Inc. reported: “Fisker Inc. announces second quarter 2022 financial results.” Highlights include:

- “…Vehicle testing and validation phase progressing well; all 55 complete Fisker Ocean prototypes built and performing various final testing before SOP on November 17, 2022.

- Sold out all 5,000 pre-orders for the launch edition Fisker Ocean One, secured by $5,000 down payments from each customer.

- Consumer demand remains strong. Fisker Ocean reservations totaled more than 56,000 as of August 1, 2022, including 5,000 Ocean One pre-orders secured by$5,000 down payments.

- Debuted the Fisker Ocean in France and the United Kingdom in June 2022.

- Confirmed Fisker PEAR, using the Fisker-developed SLV1 platform, will be manufactured at Foxconn’s newly acquired plant in Ohio.”

On August 9 Fiskerati reported:

Fisker lounges opening Fall 2022. Fisker Lounges are where you will get to learn all about and experience the Fisker Ocean for the very first time including test drives… The first Fisker Lounge will open in Fall 2022 in Los Angeles, CA at The Grove.

Fisker lounges opening Fall 2022

Fiskerati

On August 12 Fisker Inc. reported: “Fisker sells out of 2023 planned production of Fisker Ocean Sport and Ultra trims for the US market and prepares for the start of production in Austria.” Highlights include:

- “Fisker Inc. sold out of its 2023 US allotment of the Fisker Ocean Sport and Fisker Ocean Ultra trim levels.

- Last month, the company also sold out its 5,000 Fisker Ocean One launch edition globally, with buyers in nine launch markets committing to buying the limited version.

- Earlier this month, Fisker proactively reached out to US reservation holders regarding retaining eligibility for the $7,500 federal tax credit should the Inflation Reduction Act of 2022 become law.

- Fisker is exploring US manufacturing sites, as well as considering increasing Fisker Ocean production in late 2023.

- At the carbon-neutral factory in Austria, where the Fisker Ocean starts production on November 17, 2022, Fisker is preparing for large-scale manufacturing.”

On August 18 Fisker Inc. reported:

Fisker Ocean in demand: Company considering production expansion beyond 50k units per year as sport and ultra trims sell out in U.S.; strong enthusiasm sets tone for possible American Manufacturing.

You can read a Trend Investing article on Fisker Inc. here, or the European reveal of Fisker Ocean video here.

Three wheel EV companies

Arcimoto Inc. (FUV)

On August 15 GlobeNewswire reported: “Arcimoto announces second quarter 2022 financial results and provides corporate update.” Highlights include:

- “Produced 102 new customer vehicles, the highest vehicle production quarter in Arcimoto’s history.

- Delivered 41 customer vehicles, deployed 4 vehicles into fixed assets for marketing, deployed 20 vehicles into rental operations and increased finished goods inventory from 18 to 55 vehicles.

- Produced 20 rental vehicles. The rental program now totals 98 rental vehicles across 11 Arcimoto rental and partner rental locations in 5 states…”

Electrameccanica Vehicles Corp. (SOLO)

On August 11 Electrameccanica Vehicles Corp. reported: “ElectraMeccanica reports second quarter 2022 financial results.” Highlights include:

- “Company reported $1.547 million in Q2 ’22 revenue, up over 5x year-over-year and 48.9% sequentially, and EPS of ($.17) as it continues to scale.

- ElectraMeccanica manufactured a record 193 SOLOs in the period, delivering a total of 68 despite challenging operating environment.

- Business maintains over $195 million of working capital.”

EV & battery ETF

- The Amplify Lithium & Battery Technology ETF (BATT) is a broad based EV related fund worth considering. It is currently a trading on a PE of 17.71. On their website they state: “BATT is a portfolio of companies generating significant revenue from the development, production and use of lithium battery technology, including: 1) battery storage solutions, 2) battery metals & materials, and 3) electric vehicles.

Other EV or EV related companies

Other EV companies we are following include Envirotech Vehicles (EVTV) (formerly ADOMANI Inc., Atlis Motors, Ayro, Inc. (AYRO), Blue Bird Corporation (BLBD), Blink Charging (BLNK), Byton (private), Canoo (GOEV), China Evergrande New Energy Vehicle Group [HK:3333], Chery Automobile Co. Ltd. (private), Didi Chuxing, Dyson (private), Electric Last Mile Solutions Inc. (“ELMS”) (ELMS), Ferrari NV (RACE), Guangzhou Automobile Group Co., Hyliion Holdings (HYLN), Ideanomics Inc. (IDEX), Mahindra & Mahindra (OTC:MAHDY), Mazda (OTCPK:MZDAY), Niu Technologies (NIU), Proterra (PTRA), Qiantu Motor, Sono Group N.V (SEV), (Subaru (OTCPK:FUJHY), Suzuki Motor Corp. [TYO: 7269] (OTCPK:SZKMY) (OTCPK:SZKMF), Tata Motors (TTM) group (Jaguar, Land Rover), WM Motor, and Zhi Dou (private).

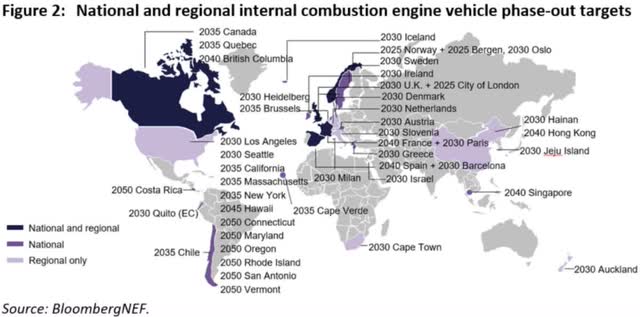

The list of countries and cities banning (or planning to ban) petrol and diesel vehicles include at least:

- Norway (2025); UK, Netherlands, Denmark, Sweden, Iceland, Greece, Ireland, Israel (2030); Scotland (2032); Hong Kong (2030-40); EU, Germany, Japan, Canada (2035); France, Spain, Egypt, Taiwan, Singapore, India, New Zealand and Poland (2040).

- Rome (2024); Athens, Paris, London, Stuttgart, Mexico City, Madrid (2025); Amsterdam, Brussels, Hainan (2030); California, New York, Quebec Province (2035); Sao Paolo, Seoul (2040).

Note: Wikipedia has an excellent list showing the phase out of fossil fuels in various cities and countries.

ICE vehicle phase-out target dates

Autonomous Driving/Connectivity/Onboard entertainment/Ride sharing [TaaS]/ EV leasing/renting

On August 29 Teslarati reported:

Tesla is focused on FSD wide release by end of 2022: Elon Musk… “Have self-driving in wide release at least in the U.S., and… potentially in Europe, depending on regulatory approval,” Musk said… Tesla’s FSD Beta fleet now numbers about 100,000 drivers…

- Trend Investing update on the sector: “An Update On The Leading Global Autonomous Vehicle Companies And What To Expect Next“

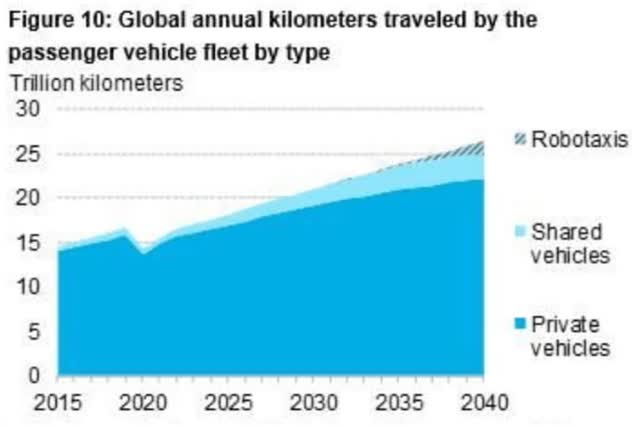

BNEF 2020 forecasts by fleet type

Conclusion

July 2022 global plugin electric car sales were up 61% YoY and reached 14% global market share; 28% share in China, 19% in Europe, and no data for July (May was 6.1%, Q2 was 5.6%) for the USA.

Highlights for the month were:

- Despite supply chain issues and a Europe slowdown, by the end of 2022 global plug-in sales are on pace to exceed 10 million vehicles.

- Inflation Reduction Act mandates escalating battery critical mineral requirements to qualify for EV tax credit. Extension of the tax credit through 2032, the removal of the unit-sales cap of 200,000 per OEM, and a new mandate for qualified cars being assembled in North America.

- CPCA raises China NEV sales forecast to 6 million in 2022. China extends NEV purchase tax exemption worth 100 billion yuan to the end of 2023.

- Xiaomi to use BYD & CATL batteries for first BEV.

- California will become the first state to ban gasoline cars (in 2035).

- France prepares 100 euros ($100) a month electric-car leasing plan.

- BYD Co achieved its highest monthly vehicle sales on record with 162,530 sales in July, a 222% YoY increase. China’s BYD plans to launch e-SUV in India. BYD Co H1, 2022 net income triples to top end of forecast.

- Tesla shareholders approve 3-for-1 stock split. Tesla lobbying Ontario government as part of effort to set up Canadian manufacturing facility. Tesla is closer to opening up Superchargers stations to other EV brands in the U.S.

- VW strikes a deal with Canada to build EV batteries… probably going to build a gigafactory in Canada so its EVs qualify for the U.S tax credit.

- SAIC Motor sales of its NEVs reached 106,000 in July, surging 118% YoY.

- Geely wants half its vehicle sales to be electric in 2023 – CEO.

- Hyundai IONIQ 5 wins Car and Driver’s 2022 EV of the Year Award.

- BMW BEV sales more than double in 1st half-year (+110.3%).

- GAC Group steps up to produce EV batteries in house.

- Great Wall Motor’s Haval brand to stop selling ICE vehicles in 2030.

- Ford to buy cheaper CATL EV batteries, raises prices of electric F-150 pickup, plans to build 2 million EVs a year by the end of 2026.

- Nio plans new brand to make more EVs affordable.

- Renault’s Megane E-Tech is now France’s most popular EV with a 100K/year run rate.

- GM is doubling its EV production target from 1 million by 2025 to 2 million.

- Toyota says there’s no EV demand – maybe try selling one the wheels stay on?

- Xiaomi in talks with BAIC to reach goal of making cars.

- Lucid Motors slashes 2022 production target in half.

- Polestar 6 to enter production.

- Tata Motors wins order of 921 electric buses from Bengaluru Metropolitan Transport Corporation.

- Nikola agrees to acquire Romeo Power, to bring battery pack engineering and production in-house.

- Honda Motor, LG Energy to build $4.4 bln U.S. EV battery plant.

- Lordstown Motors plans Endurance to be ready for Q3 commercial release limited production and Q4 customer deliveries.

- Arrival to reportedly shelve Bus and Uber Car to cut costs and prioritize Van deliveries.

- Fisker Ocean reservations totaled more than 56,000 as of August 1, 2022. Fisker Ocean starts production on November 17, 2022.

- Tesla is focused on FSD wide release by end of 2022, at least in the U.S. and potentially in Europe, depending on regulatory approval.

As usual all comments are welcome.