Stocks have been under pressure over the last several months with volatility increasing amid the ongoing Russia-Ukraine crisis dominating headlines. Surging energy prices are adding to what is already an elevated inflationary environment may pressure consumer spending going forward.

While these serious market headwinds are expected to continue for the foreseeable future, the silver lining is that the current environment could end up accelerating trends towards clean energy and renewables as policymakers look for alternatives to fossil fuels. From there we believe the setup is also bullish for the electric vehicles segment that may end up getting a boost of demand with consumers seeking relief from gas prices at near-record levels

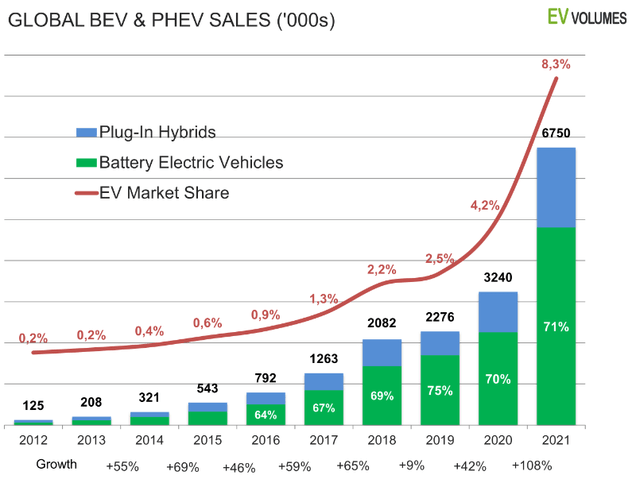

Indeed, the momentum in EVs has been building over the last several years with the global share of battery electric vehicles and plug-in hybrids nearly doubling in 2021 to 8.3% from 4.2% in 2020. There are forecasts for the U.S. level of penetration to reach 30% by 2030. Globally, governments are incentivizing “net-zero” initiatives and electric vehicles are a part of the solution.

SimonSkafar/E+ via Getty Images Source: EV-Volumes.com

Putting it all together we are bullish on EVs and several stocks that are well-positioned to capture these trends. That said, not all EV stocks are created equal or make for particularly attractive investments. We highlight 4 names we are bullish on and 3 we’re leaving unplugged.

Bullish – Tesla Inc. (TSLA)

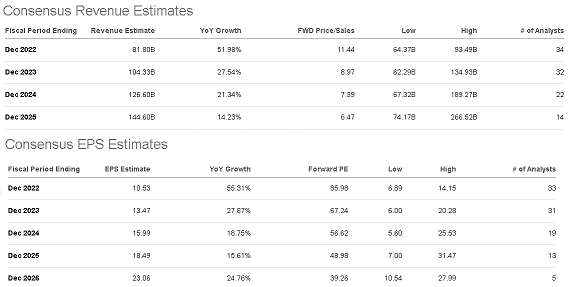

Whether you own a Tesla, want to buy one or not, the reality is that the company has proven doubters wrong over the past decade and now stands as the undisputed benchmark for all other EV companies. While shares trading at a forward price to sales ratio of 11x and forward P/E of 86x may represent a sticker shock to some, we view the growth momentum including the market consensus for EPS to more than double over the next five years as justifying the current multiples. Our thinking here is that the company will continue to lead the sector higher with its leadership position driving a valuation premium into what remains a positive long-term outlook.

Seeking Alpha

There is an understanding that Tesla’s current 70% EV market share in the U.S. will gradually decline over the next decade as other competitors come to market. Still, the attraction here is that it should continue to grow into an expanding market with the possibility that the demand for EVs is underestimated.

Part of what has made Tesla so successful is its ability to bundle subscriptions and services on top of vehicle pricing which has supported strong margins and climbing profitability. In our view, strong demand for options like sell-driving capabilities and over-the-air performance enhancements should allow the company to outperform earnings expectations as a catalyst for the stock this year.

We think the TSLA looks interesting here under $1,000 and see the previous all-time high around $1,200 as an upside target the stock can reclaim later this year. In many ways, a bullish call on Tesla is a high-beta bet on the broader market. Getting past the Russia-Ukraine crisis, we believe TSLA can lead mega-cap tech names higher.

Bullish – ChargePoint Holdings Inc. (CHPT)

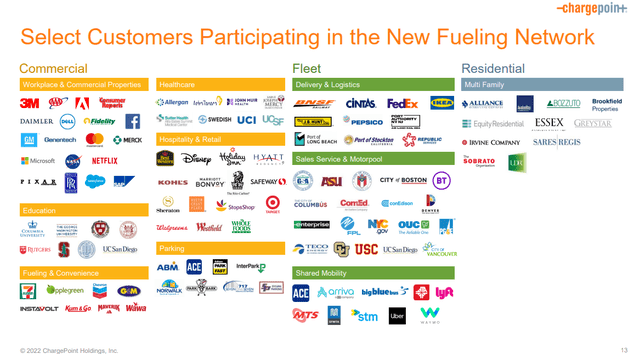

One of the bottlenecks for the proliferation of electric vehicles in the United States is the charging infrastructure or lack thereof. In this regard, the outlook for ChargePoint Holdings is strong as the company has positioned itself as the largest supplier of both commercial, fleet, and consumer electric fueling services. The bullish case here is that the company will grow over the next few years alongside EV penetration with millions more electric vehicles expected on the road.

The graphic above highlights how ChargePoint works with different types of customers to install charging stations at workplaces, parking lots, retail locations, and delivery hubs. The company also works with multi-family residential developers to install chargers in tenant facilities as homeowners look for nearby convenience representing an important tailwind.

The entire business model is leveraged thoroughly at services ecosystem that includes subscriptions and a mobile app with in-car integration. The economics based on a long tail of recurring revenues will be a positive earnings driver going forward. We are bullish on the stock and see the selloff this year with shares of CHPT as a buying opportunity.

Bullish – Proterra Inc. (PTRA)

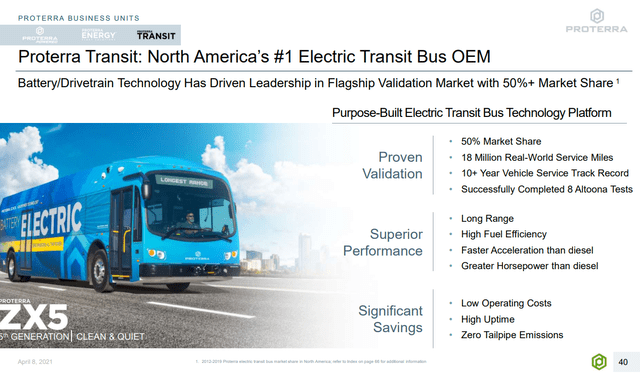

With passenger vehicles often commanding much of the attention among EV stocks, the opportunity on the commercial and transit side is potentially even larger and still in the early stages. Proterra Inc is a leader in this category with end-to-end drivetrain solutions along with battery and EV systems. In other words, Proterra makes critical components used by other EV manufacturers along with its own line of vehicles.

One of the most bullish trends is the company’s leadership in the U.S. electric transit bus market, already commanding a +50% market share with over 600 models on the road right now. The outlook is that by 2025 50% of all new buses sold in North America will be electric as states and municipalities go in that direction. By 2040 over 25,000 North American buses will need to be 100% zero-emission to reach existing government mandates.

The story for Proterra is an expectation for ramped-up manufacturing starting this year. A target of reaching $2.5 billion in annual sales by 2025 from $240 million last year highlights the appeal of the stock. We believe shares are undervalued into the opportunity which likely gets a demand boost amid the current energy pricing environment.

Bullish – BYD Company Limited (OTCPK:BYDDY)

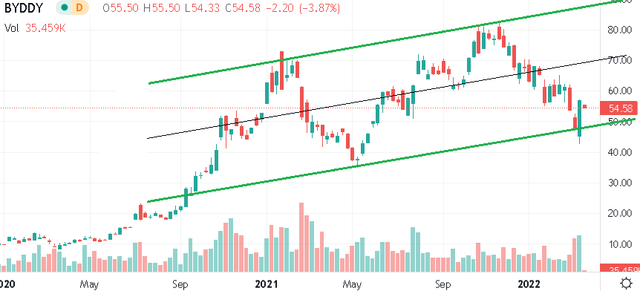

Investing in China has nearly become taboo considering the disastrous performance of the region’s stocks over the past year with deep concerns regarding the regulatory environment and even possible ADR delistings. That said, the segment got some relief last week from new comments by the government suggesting a move to support the financial stability cognizant of the impact of the extreme volatility to the broader economy from poor investor sentiment. The effort was enough to spark a rally across most Chinese equities, potentially removing one layer of concerns.

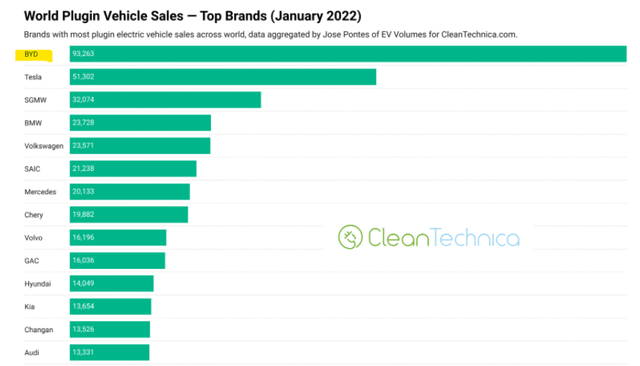

For investors willing to climb what remains a Great Wall of Worry considering the broader global macro environment, Chinese EV manufacturer BYD Company is worth a look. The company focusing on the mass-market segment opportunity in China with an extensive lineup is recognized as the world’s largest manufacturer of plugin vehicles, selling 93k units in January compared to 51k by Tesla.

BYD benefits as the largest company in the largest market in the world for EV penetration where “new energy vehicles” are on track to represent 20% of all sales this year. As it relates to China’s regulatory environment, we sense that BYD is less exposed compared to the “tech” and internet platforms that have broader security and privacy implications. The Chinese government is pursuing clean energy initiatives and BYD’s core product ends up furthering that strategy. It’s encouraging to see that the stock has been relatively resilient over the past year and we believe it can gain momentum as risk sentiment improves.

Bearish – Electrameccanica Vehicles Corp. (SOLO)

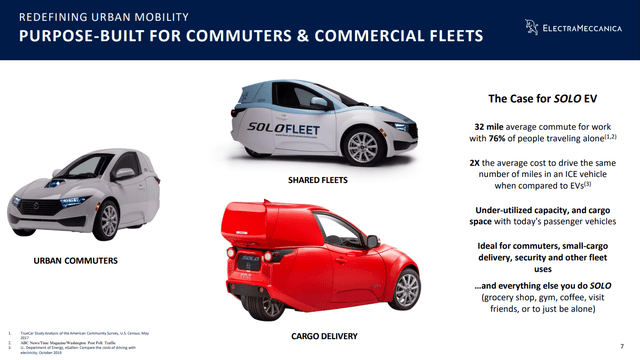

Electrameccanica is all-in on its “SOLO EV” as a three-wheeled, single-seat electric vehicle platform. The idea here is that with a price point under $20k, SOLO represents an affordable and urban-friendly option for commuters. The company also sees a large opportunity in small-cargo delivery, and other utility applications with its $25k “SOLO Cargo EV”. The product is real and the company last announced delivering about 20 units this year with a plan to ramp up production towards a potential capacity of 20,000 units per year.

We have nothing against the company but are nevertheless highly skeptical of the bullish case. While the single rider format can work for some applications, it’s hard to justify the price point compared to a motorcycle or even less expensive multi-seat small-vehicle alternatives that can serve the same functions. While it may be true that “76% of people commute to work alone”, those potential target customers likely also use their vehicles outside of work and it’s nice to have the flexibility of carrying passengers.

It’s a hard sale to get people to buy one of these in addition to owning a regular car. In our view, SOLO is a niche product that will be difficult to scale to a level necessary to justify the company’s $250 million valuations. The stock will likely continue getting dragged lower on recurring negative cash flows and the key risk is that it misses targets over the next several quarters.

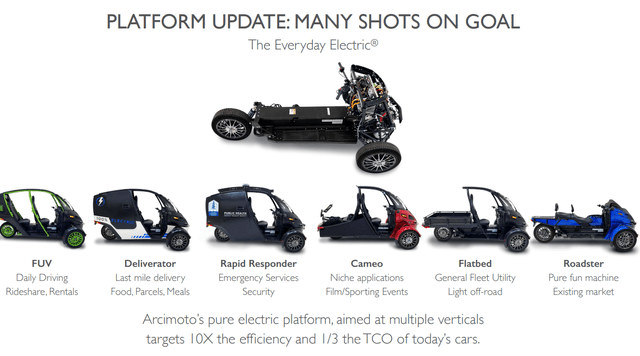

Bearish – Arcimoto, Inc. (FUV)

Speaking of three-wheeled EVs, Arcimoto Inc. is focusing on the more recreational side of the market segment with its “fun-utility-vehicle“. The FUV draws similarities to an “e-bike” with an open-air cockpit design. Arcimoto sees applications beyond recreation with last-mile delivery and light-utility versions. In many ways, the existence of Arcimoto, Inc. furthers the bearish case on Electrameccanica highlighting what is a highly competitive segment that hardly makes FUV or SOLO unique. On this point, there is also Ayro, Inc. (AYRO) which we are a bit more favorable towards as it sticks with the four-wheel design but also offers similar functionality.

Again, the FUV product is fine for what it is but we just don’t believe the company will be able to hit the targets necessary to justify its valuation. The challenges of ramping up manufacturing and the logistics involved mean profitability will likely remain out of reach for the foreseeable future. At the end of the day, the FUV and SOLO are “souped-up golf carts” that just don’t have the technological differentiation to command a pricing premium at retail over more affordable legacy options.

Bearish – Lordstown Motors Corp. (RIDE)

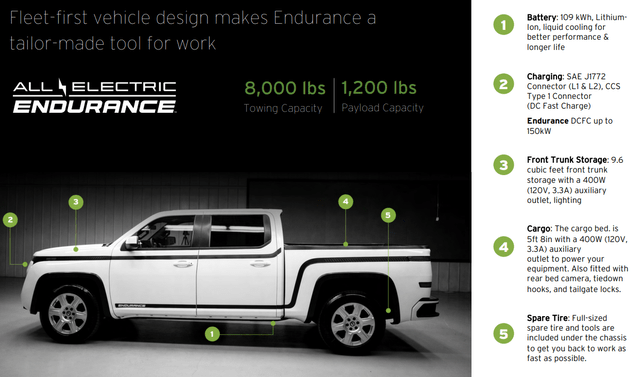

Lordstown Motors is developing its “Endurance” electric pickup truck which has been plagued by delays but is now slated to begin production by Q3. Citing cash flow challenges, the company sold its Ohio facility to Taiwanese manufacturing giant Hon Hai Precision Industry Co., Ltd., better known as “Foxconn” late last year while the deal is still pending with some ongoing uncertainty to the final terms.

The challenge we see in RIDE is that the company has some serious fundamental challenges and cash flow issues. For context, the company reported $85 million in negative operating cash flow just during the last quarter against effectively zero revenues while only holding around $245 million in cash and equivalents. The cash from the Foxconn deal was cited in the last earnings conference call as critical to funding operations this year.

The company will need to continually tap the equity market with recurring stock issuance and dilute existing shareholders to support its operations for the foreseeable future. Earlier this month, it was reported that General Motors Corp. (GM), an early backer had fully exited its investment in the company which we read as throwing in the towel. The risk here is that Lordstown will not survive through the next few years with our without the Foxconn partnership. In our view, it’s not worth the risk that faces significant execution hurdles even in a best-case scenario.

Final Thoughts

It remains a complex market environment with many moving parts and macro uncertainties. We expect volatility to continue but see room for high-quality stocks with a positive outlook to outperform going forward. In the U.S., resilient economic growth including a tight labor market and what we believe to be a post-pandemic reopening boom can help balance some of the headwinds.

The recent selloff and share price weakness have helped balance valuations setting up a potentially attractive entry point, particularly among beaten-down EV names. Recognizing the ongoing risks, the strategy is to average into trade with small sizing over days and weeks to secure a favorable low-cost basis. The potential for a resolution to the Russia-Ukraine situation can open the door for more positive risk sentiment.