This article first appeared in Trend Investing on August 21, 2020.

Arcimoto Inc. (NASDAQ:FUV)

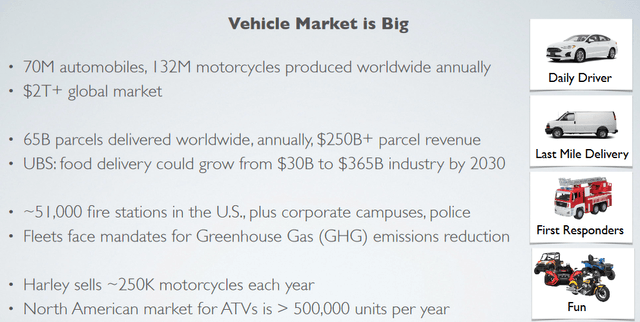

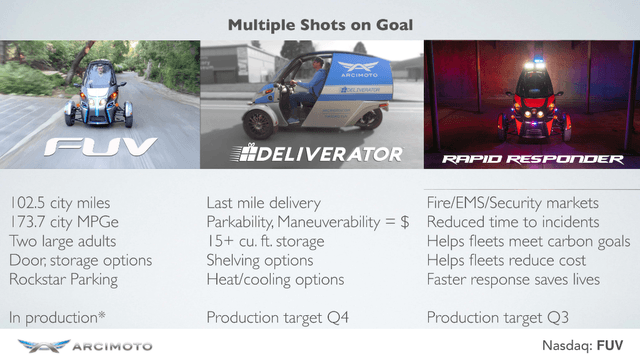

Arcimoto is an electric vehicle company headquartered in Eugene, Oregon that manufactures and sells the ‘Fun Utility Vehicle’, or FUV, a tandem two-seat, ‘three-wheeled’ electric vehicle. Arcimoto’s vehicles are fun, affordable, ultra efficient, small-footprint electric vehicles. Apart from the personal use segment, Arcimoto is also targeting the deliveries and fleet sectors with their “deliverator’ and ‘rapid responder’ FUV fully electric tricycle.

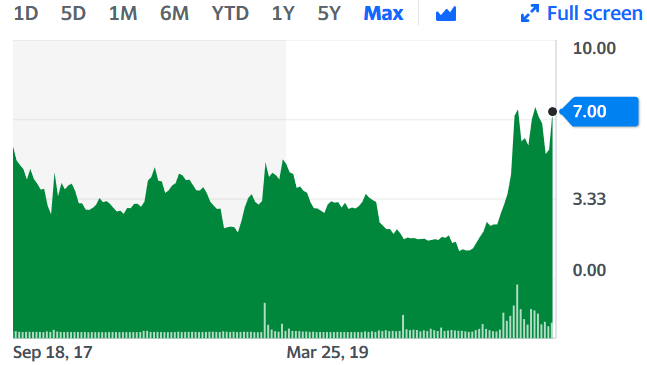

Arcimoto stock price chart since inception

Source: Yahoo Finance

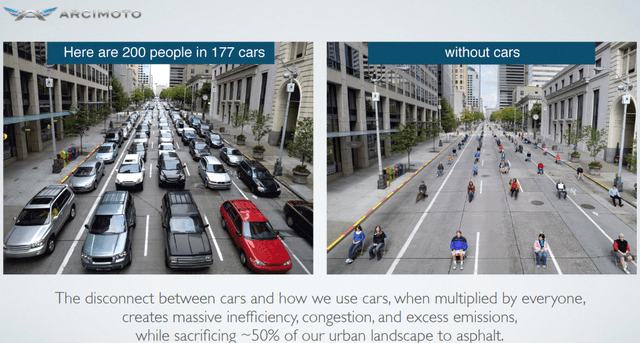

Arcimoto’s mission statement is:

Our mission is to catalyze the shift to a sustainable transportation system. We believe that will only happen when we move away from oversized, overpriced, polluting vehicles to right-sized, ultra-efficient EVs we all can afford. We can’t afford not to.

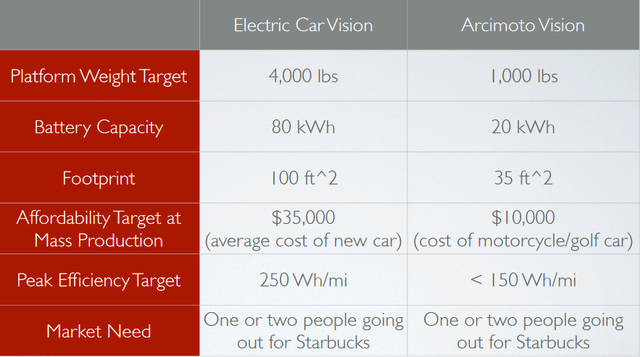

Arcimoto vision – Smaller, affordable and fun EVs

Arcimoto background

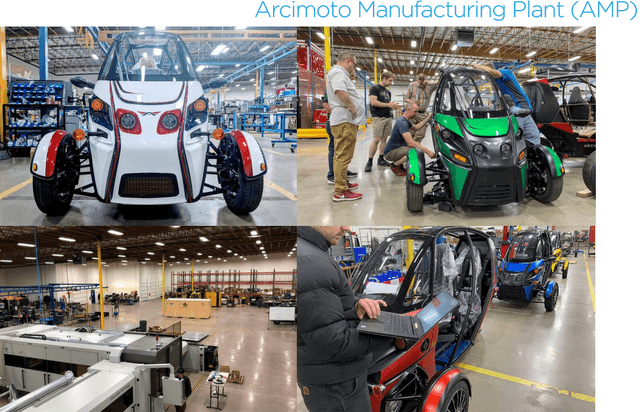

Arcimoto listed on the Nasdaq in September 2017 and built out a state-of-the-art production facility in Eugene, Oregon. The Company has completed regulatory compliance for the Fun Utility Vehicle and initiated production in September 2019. Pilot programs are underway with the Deliverator and the Rapid Responder, with production of those vehicles set to begin in late 2020.

Arcimoto is currently undergoing a study by Munro & Associates to see how they can better boost efficient high production volume. For now, the initial concept target is to reach a rate of 50,000 FUV’s pa production within 24 months. This may be updated as the study is still ongoing. Currently Arcimoto’s Eugene factory has a size capacity of about 5,000 FUV’s per day, so as production increases Arcimoto would look to expand or new premises.

Arcimoto’s three wheel ‘Fun Utility Vehicle’ [FUV] EV

Arcimoto’s first and only production vehicle so far is the ‘Fun Utility Vehicle’. It is a fully electric, three wheel, two person legal vehicle with a 20kWh Li-ion battery. The FUV’s top speed is 75 mph, with a range of 100 miles under average city driving conditions (up to around 40 mph, stop and go). The FUV is a dual electric motor, front wheel drive.

Arcimoto’s 3 wheel EV – The ‘Fun Utility Vehicle’

Source: www.arcimoto.com

Arcimoto’s target market is for those wanting a fun and efficient EV for shorter trips, with a maximum of 2 occupants, in a safe and stable three wheeled vehicle. Arcimoto sees their FUV as between the motor bike and the micro-car market.

As stated earlier Arcimoto currently has only one vehicle in production, their FUV. However, it can be sold in various formats such as:

- FUV – A personal ‘Fun Utility Vehicle’.

- Deliverator – Suitable for last mile delivery.

- Rapid Responder – For emergency services.

Arcimoto is looking at introducing various optional extras such as clear sheet side weather protection etc.

Arcimoto’s FUV currently has three versions

Arcimoto’s pre-orders, sales, prices, and production

Arcimoto has an online sales model similar to Tesla (TSLA) and they also have a renting option so customers can get to better experience the product. Arcimoto states that they have ~4,400 ($100 refundable) pre-orders for the US$20,000 FUV as of the August Q2 Company earnings update. To date the Company has built ~113 FUV’s (noting Q2 was negatively impacted by COVID-19 shutdowns). Currently, the Company is severely production constrained at about 3 FUV’s per day and a growing order book. Hence, the Munro exercise to dramatically improve efficiency and scale production ideally to about 50,000 pa over the next 24 months. Arcimoto has an aspirational goal to get the FUV price lower as they mass scale, ideally somewhere towards the US$10,000 mark. The 5 year plan would be to ‘copy and paste’ the US factory and business model and manufacture and sell locally on a global basis.

Subsidies for Arcimoto’s three-wheel EVs

For now US national subsidies are only for 4 wheel and 2 wheel EVs, something the Company is working on changing. Some US States do give a subsidy for three wheelers such as Oregon (US$2,500 credit) and California (US$900 credit).

Latest news and earnings results

- June 10, 2020 – Arcimoto Announces Strategic Agreement With Munro & Associates To Plan For High Volume Production of Ultra Efficient Electric Vehicles

- June 11, 2020 – Q1, 2020 earnings update – “To date, the Company has built more than 100 production vehicles, up from the 57 produced at December 31, 2019. The Company incurred a net loss of $3,594,774, or ($0.15) per share, in the first quarter of 2020 versus a net loss of $3,068,393 or ($0.20) per share, for the same prior-year period.”

- July 9, 2020 – Arcimoto Announces $10 Million Common Stock Only Registered Direct Offering – “The Company intends to use the net proceeds from the offering for general corporate purposes, including working capital, acceleration of the manufacture of finished goods for delivery against pre-orders and to address the increased customer demand in its products.”

- August 19, 2020 – Q2, 2020 earnings update –

Q2 2020 and Recent Company Highlights:

- “Began design evaluation with Munro & Associates to improve Arcimoto’s manufacturing processes and supply chain management with goal to drive down costs and begin high-volume production of ultra-efficient electric vehicles at rate of 50,000 vehicles per year within 24 months.

- Launched first restaurant delivery pilot program for the Deliverator with Wahlburgers Key West.

- In Q2, raised a total of $16.5 Million with two common stock only registered direct offerings and retired all convertible and senior secured notes. In July, raised an additional $10 Million with common stock only registered direct offering, and $1.6 Million from exercise of warrants.

- Launched first Deliverator rental program in Los Angeles with HyreCar, targeting gig drivers for local food and grocery delivery.

- Announced that Progressive Motorcycle Insurance is now available for Fun Utility Vehicle.

- We have resumed production at low volume, and plan to resume deliveries this quarter. We rolled out more Deliverator pilot vehicles: two to HyreCar in Los Angeles to validate the product’s utility for gig delivery driving, and one to the newest Wahlburgers in Key West, to validate the platform for restaurant meal delivery.

- Our newly expanded support department can now rapidly respond to early outstanding service items typical of new vehicles. We’ve also expanded the Arcimoto R&D facility, and we now have the capacity to create the full range of future Arcimoto platform products, options, and accessories.

-

Second Quarter of 2020 Financial Results

Total revenue in the second quarter of 2020 was $268,538 as compared to revenue of $8,514 for the same period in 2019. The increased revenue in the current year period was due to continued sale of FUV and Deliverator products to customers that began in late 2019 following the start of commercial production. However, revenue in the second quarter of 2020 was negatively impacted by the suspension of all vehicle production operations in response to the COVID-19 pandemic. Prior to the suspension, the Company had increased production capacity to two vehicles a day, up from the one per day initial production rate. To date, the Company has built more than 100 production vehicles, up from the 57 produced at December 31, 2019.

The Company incurred a net loss of approximately $3.7 Million or ($0.15) per share, in the second quarter of 2020 versus a net loss of approximately $3.9 Million or ($0.23) per share, for the same prior-year period. The loss is attributable to significantly higher cost of goods sold offset partially by the higher revenue and lower research and development expenses in the current-year period.

The Company had approximately $7.8 million in cash and cash equivalents as of June 30, 2020, compared to approximately $5.8 million in cash and cash equivalents as of December 31, 2019.”

Valuation

The current market cap is US$220m with 31.51 million shares outstanding. The stock is up 113% over the past year.

As of mid August cash on hand was ~US$20m (plus US$5.5m in parts inventory). The Company is debt free except for US$1.6m equipment capital lease financing.

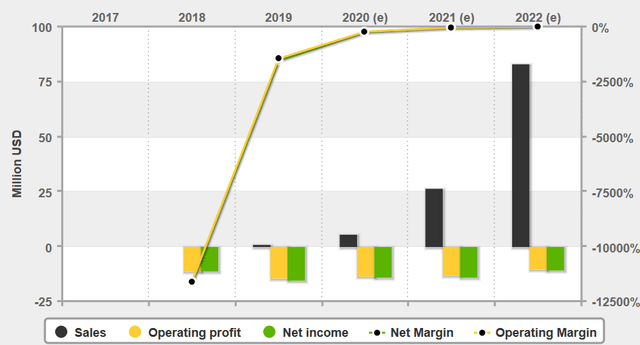

Total revenue for Q1 2020 was US$616,795, and for Q2 US$268,538 (Q2 was lower due to a COVID-19 plant shutdown). The Company is currently making a loss with US$3.7m cash burn last quarter. Revenues are forecast to rapidly rise from an estimated US$6m in 2020, to US$27m in 2021 and US$83m in 2022. It looks like the 2020 forecast may have been made before the COVID-19 interruption to Q2 production.

4-traders has an analyst’s consensus ‘outperform’ and a price target of US$7.70, representing 10% upside.

The low market cap reflects the low number of sales to date and lack of profitability and cash burn at this stage.

Arcimoto’s financials and forecast financials

Source: 4-traders

Management

Founder and CEO of Arcimoto Mark Frohnmayer has about a 22.9% equity share in the Company which is great. Mark graduated from UC Berkeley in 1996 with a degree in Electrical Engineering and Computer Science. He has an IT background being a former computer games developer. Similar to the Elon Musk story, Mark co-found GarageGames then sold that and used the proceeds to start up Arcimoto in 2007, in Eugene Oregon. Since 2007 Mark has developed several iterations of the FUV, leading to Arcimoto’s first FUV production in September 2019.

Source: Forbes

Risks

- EV adoption rates may stall, EV subsidies may decrease, other legislative changes may impact the EV sector, technology change.

- Will consumers buy Arcimoto’s smaller fun, two person, three wheel, EVs. So far it looks promising.

- Competition risk – Can Arcimoto compete with competitors or cheaper Chinese products. So far there looks to be a gap in the market. For example EV startup Electrameccanica (SOLO) has a single person three wheel enclosed EV. A two person EV is a better option.

- Business risks – Management, debt, liquidity and currency risks. Start-ups and small cap stocks can fail to raise capital. Arcimoto is burning cash at over $3m a quarter, so is being funded by equity investors for now. Further CapEx will be needed to expand production. Arcimoto may be able to access the US Gov. ATM program for Treasury interest rate loans similar to what Tesla did.

- The usual stock market risks (liquidity, sentiment etc.). Sentiment towards EV start-ups is currently high.

Further reading

Conclusion

For a small low market cap stock Arcimoto has already made some great achievements. These include a highly prized Nasdaq listing, small scale production and sales of their FUV vehicle, and about 4,400 pre-orders for the FUV. At this point the Company is severely production constrained at 3 FUV’s per day capacity (113 only produced so far), hence they are currently undergoing a review by Munro & Associates with a target to increase production to 50,000 pa within 24 months.

The FUV sale price is currently US$20,000 due to lack of economies of scale, but the Company’s aspirational target price is US$10,000. Over time, and with a lower price point I would estimate pre-orders could increase exponentially and sales could easily reach 50,000 pa in 24 months from now. The Nasdaq listing, possible access to US Gov. cheap funding, and a growing following of investors looking for the next Tesla could mean capital raising to rapidly expand production should be achievable. Longer term the Company plans to expand their product line and to further expand their sales globally similar to what Tesla has done, but for smaller and cheaper fun EVs.

Risks are due to the early stage of the Company with limited production capacity at this time and the associated quarterly cash burn. See the risks section.

Valuation is hard to assess for early stage companies. I like that their CEO has a significant ~23% equity share in Arcimoto. Certainly the market cap is several fold cheaper than most other four wheel EV startups, but it should be noted Arcimoto’s market is the 3 wheel EVs (between a bike and a car) and they are already at small scale production. If they can ramp to producing and selling 50,000 EVs pa within 24 months, then their cash flow should be much better and the risks much less.

I rate Arcimoto as a fun very speculative buy, with huge upside potential if things go well. Suitable for high risk tolerant investors with a long-term horizon.

As usual all comments are welcome.